You know your business, we know business finance

It takes minutes to apply, there’s no obligation, and it’s easy to use.

Match with 120+ Lenders

It’s free to apply and it doesn’t affect your credit score

Expert help throughout the process

Loans from £1000 to £20M

Tide business services

Access a host of free smart business tools today

Connect your existing business bank account to Tide today to get access to a host of smart tools for free, including Invoicing and *Tide Accounting. All designed to help small businesses save time on their finance admin.

Find out moreHow does it work?

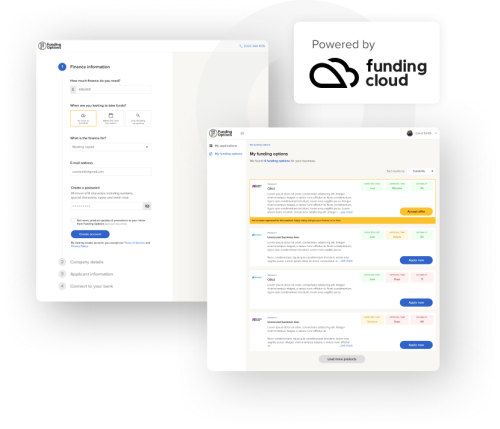

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.

Our products

Click below to find out more about each of our products

Business Loans

Invoice Finance

Asset Finance

Property Finance

Commercial Mortgages

Working Capital

Business Cards

Financial product information

Representative example*

7.63% APR Representative based on a loan of £50,000 repayable over 24 months. Monthly repayment of £2,252.94. The total amount payable is £54,070.56

*Some lenders may apply fees during the application process, please note that these are set and provided by these entities.

Annual Percentage Rate

Rates from 2.75% APR

Repayment period

1 month to 30 years terms

funded to UK businesses

happy customers

Tide business services

All your business needs in one place

Connect your existing business bank account to Tide today to get access to a host of free smart tools.

Green Finance initiative

Funding a greener future

We’re driving sustainability into the SME lending market by connecting businesses to the funding they need to reach net zero.

Find out more

Our Partners

Our partners are some of the best in the industry. Together, we're able to help even more businesses access finance. If you're an accountant, consultant, broker or supplier with clients in need of our service, join our growing panel of partners today.

Want to know more?

Get in-depth information about financing your business.

Finance by type

Finance by situation

Business Funding UK

Let us help you find the best business finance solutions in the market. We will guide you through the whole process and make sure you get the best deal.

See your Funding OptionsMatch with 120+ Lenders

It’s free to apply and it doesn’t affect your credit score

Expert help throughout the process

Loans from £1000 to £20M